Aadhaar Card Link With Pan Card

Aadhaar Card Link With Pan Card:

Permanent Account Number (PAN) refers to a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department in India.

Permanent Account Number is a permanent number which does not change during the lifetime of the PAN holder and also serves use as an important ID proof. pan card is also use part for the opening bank account both saving and current accounts. We can not fill our income tax and returns without pan card.

स्थायी खाता संख्या (पैन) भारत में आय कर विभाग द्वारा एक लेटेनेटेड कार्ड के रूप में जारी किए जाने वाले दस अंकों के अल्फ़ान्यूमेरिक नंबर को संदर्भित करता है। स्थायी खाता संख्या एक स्थायी संख्या है जो पैन धारक के जीवनकाल में बदलती नहीं है और एक महत्वपूर्ण आईडी प्रमाण के रूप में भी उपयोग की जाती है। पैन कार्ड भी प्रारंभिक बैंक खाते में दोनों बचत और चालू खाते के लिए हिस्सा लेता है। हम पैन कार्ड के बिना हमारा आय कर और रिटर्न नहीं भर सकते।

Permanent Account Number (PAN) is a ten-digit alphanumeric number issued by the Income Tax Department (ITD) of India. The PAN (Permanent Account Number) card is an important document for conducting even the most simplest of financial transactions like opening a savings bank account or applying for a debit/credit card or when filing their tax return.

The PAN card number is a most mandatory requirement for filing tax returns and also for making financial investments or opening bank account and all financial process. Without the PAN(Permanent Account Number) we don’t fill tax return.

A PAN card is a card issued under the Income Tax Act, 1961 and it contains a unique 10-digit alphanumeric code. This code is computer-generated and is unique to the holder of the card. The Central Board of Direct Taxes (CBDT) recently announced that it has extended the deadline to link PAN and Aadhaar to March 31, 2018.

The Income Tax Department has made compulsory for taxpayers to link your documents with your Aadhaar card and aadhaar number. Aadhaar card must link with pan card. Aadhaar card is mandatorily be required while paying income tax and filing returns.

How to link Aadhaar card with PAN?

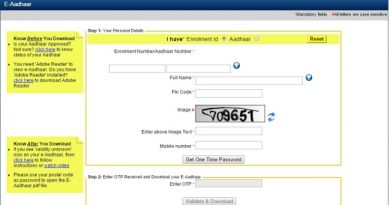

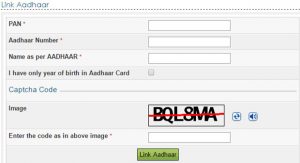

Online Aadhaar linking via e-filing website:

A facility available on the Income Tax Department’s e-filing website. the candidate go to on e-filing website and then after select Link Aadhaar then after provide PAN, AADHAAR CARD NUMBER, Name as per AADHAAR and select I have only year of birth in Aadhaar Card or fill the Captcha Code and Click on LINK AADHAAR button.

Aadhaar linking via SMS:

Send SMS to 567678 or 56161 from your registered mobile number in following format:

UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN>

Example: UIDPAN 123456789123 AKPLM2124M